Following Jio, Airtel raises mobile tariffs from 3 July, check details and new tariffs

Following the recent tariff hike by Reliance Jio, telecom major Bharti Airtel has also announced an increase in mobile tariffs effective 3 July 2024. This move comes as Airtel aims to maintain a financially healthy business model for telcos in India, targeting an average revenue per user (ARPU) upwards of ₹300.

Details of the Tariff Hike:

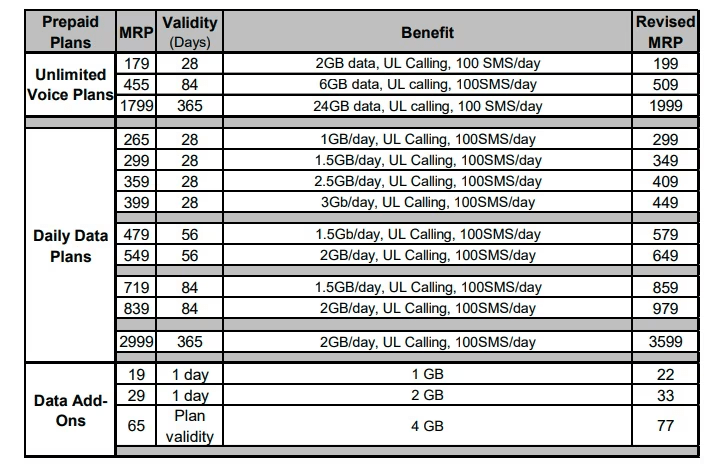

- Prepaid Plans:

- Increase ranges between 11% and 21%.

- Entry-level plan now costs ₹199, up from ₹175.

- Full-year validity plan increased to ₹3,599 from ₹2,999 (21% increase).

- 56-day validity plan with 2GB data per day now costs ₹579, up 21%.

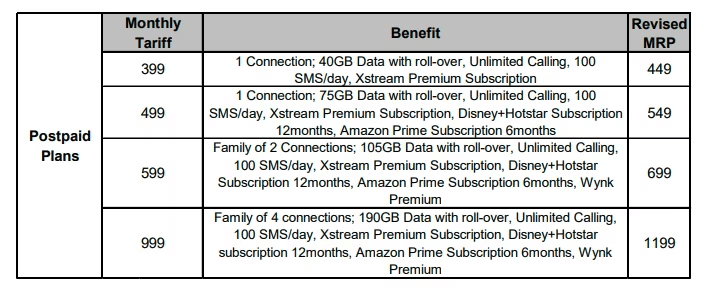

- Postpaid Plans:

- Increase ranges between 10% and 20%.

- Entry-level plan now costs ₹449, up from ₹399 (12.5% increase).

- ₹999 plan now costs ₹1,199 (20% increase), includes four connections, 190GB data with roll-over, annual subscriptions to Xstream Premium, Disney+Hotstar, six months of Amazon Prime, and Wynk Premium.

Check Updated Tariff Plans Below

Updated Post-Paid tariff Plans Below

Airtel has stated that the price increase is “modest” to avoid burdening customers’ budgets. The carrier emphasized that the modest price increase (less than 70p per day) on entry-level plans aims to minimize the impact on budget-challenged consumers.

Comparison with Reliance Jio

Reliance Jio, the market leader by subscribers, announced tariff hikes between 12% and 25% on 27 June. Unlike previous instances where Airtel led with tariff changes, Jio was the first to announce the hikes this time.

- Jio’s Tariff Plans:

- New plans effective from July 3.

- Unlimited 5G data only on plans providing 2GB data per day and above.

- Consumers must switch to the ₹349 plan for unlimited 5G services, a 46% increase.

Industry Impact and Future Outlook

According to brokerages, Jio’s move is seen as a step towards monetizing 5G services. Both Airtel and Jio currently offer 5G services at the same tariffs as 4G, with Airtel’s CEO Gopal Vittal affirming no differential pricing for 5G services.

Analysts predict the tariff hike and moderation in capital expenditure will benefit the industry, with revenue growth likely to remain in double digits as customers upgrade to bundled plans, boosting carriers’ free cash flows. Telecom stocks have reflected this optimism, with Airtel’s stock rising over 71% in the past year compared to Nifty 50’s 28% gain.

Future Expectations

Industry insiders anticipate Vodafone Idea to follow suit with tariff changes. The tariff hikes and focus on improving returns on investments, particularly by Reliance Jio, are expected to bode well for the telecom sector.

Analysts at Kotak Institutional Equities highlighted the pressing need for Jio to raise tariffs, citing its larger 5G investments and moderation in returns on capital employed (RoCE) and free cash flow (FCF).

In summary, the telecom industry is witnessing a significant shift with leading carriers raising tariffs to ensure sustainable growth and investment in advanced network technologies. Airtel’s and Jio’s moves signal a broader trend towards higher ARPU and better financial health for the sector.