GST Council Exempts Hostels, ESOPs, Platform Tickets and More from GST

The 53rd GST Council meeting, chaired by Finance Minister Nirmala Sitharaman on June 22, 2024, brought forth several pivotal measures aimed at streamlining the tax system and providing financial relief in various sectors. The session, attended by state finance ministers, focused on implementing new tax amendments, integrating Aadhaar biometric authentication, and introducing significant GST exemptions.

Aadhaar-based Biometric Authentication

To combat fraudulent input tax credit claims made through fake invoices, the GST Council has decided to roll out Aadhaar-based biometric authentication nationwide. Finance Minister Nirmala Sitharaman emphasized that this initiative would enhance tax compliance and reduce fraudulent practices.

GST Rate on Milk Cans

The Council announced a uniform GST rate of 12% for all milk cans, irrespective of whether they are made of steel, iron, or aluminum. This measure is expected to standardize the tax treatment of milk cans and simplify the tax regime for dairy producers and suppliers.

Petrol and Diesel Under GST

The central government reiterated its intent to bring petrol and diesel under the GST regime, highlighting the necessity of consensus among states on the applicable tax rate. This move aims to achieve uniform taxation for fuel across the country, potentially stabilizing fuel prices.

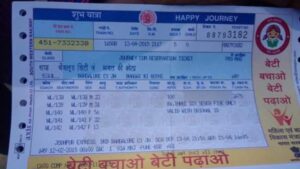

GST Exemption for Railway Services

One of the major announcements was the GST exemption on platform tickets, which is aimed at reducing the financial burden on railway passengers. This decision is part of a broader effort to make railway services more affordable and accessible to the general public.

Reduction in GST for Carton Boxes

In a move that benefits both manufacturers and consumers, the GST rate on various types of carton boxes has been reduced from 18% to 12%. This reduction is intended to lower the overall cost of these essential packaging materials, thereby benefiting multiple industries reliant on packaging.

GST Exemption for Hostel Accommodation

The Council also granted a GST exemption for services related to hostel accommodation outside educational institutions, up to ₹20,000 per person each month. This exemption aims to make hostel accommodation more affordable for non-student residents, providing financial relief to many individuals.

Key Takeaways

- Aadhaar-based biometric authentication: Nationwide rollout to curb fake invoicing.

- GST on milk cans: Uniform 12% rate on all materials.

- Petrol and diesel: Ongoing discussions to include under GST.

- Railway services: GST exemption on platform tickets.

- Carton boxes: GST reduced from 18% to 12%.

- Hostel accommodation: GST exemption up to ₹20,000 per person/month outside educational institutions.

The 53rd GST Council meeting’s decisions reflect a strategic approach to enhancing tax compliance, reducing financial burdens on the public, and simplifying the tax regime. These measures, including the significant GST exemption on platform tickets and other sectors, are set to have a far-reaching impact on the Indian economy.